vermont income tax rate 2020

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66. The lesser of 4 of your.

What Students Need To Know About Filing Taxes This Year Money

Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid.

. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. 186 average effective rate. Compare your take home after tax and estimate.

The first 715 million of capitalization contributed by taxpayers on or before January 1 2020. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. There are -894 days left until Tax Day on April 16th 2020.

The taxable wage figures are taken. Any income over 204000 and 248350 for. Detailed Vermont state income tax rates and brackets are available on this page.

The rate notice provides you with your new unemployment tax rate. Vermont Income Tax Rate 2020 - 2021. VT Taxable Income is 82000 Form IN-111 Line 7.

Tax Year 2020 Personal Income Tax - VT Rate Schedules. BA-403 Application for Extension of Time to File Vermont CorporateBusiness Income Tax Return CO-414 Estimated Payment Voucher. Personal Income Tax - 2020 VT Tax Tables.

RateSched-2020pdf 11722 KB File Format. Vermont Federal and State Income Tax Rate Vermont Tax Rate Vermont tax tables Vermont tax withholding Vermont tax tables 2020. There are -908 days left until Tax Day on April 16th 2020.

As you can see your Vermont income is taxed at different rates within the given tax brackets. 1210 cents per gallon of regular gasoline 28 cents per gallon of diesel. Vermont Income Tax Return.

When finished click the Continue button. There is a four-year carryforward. Income Tax Booklet The.

It is sent out annually in June and the rate is effective from July 1st until June 30th. Monday March 1 2021 - 1200. Vermonts income tax brackets were last changed two.

The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax. CO-414 Estimated Tax Payment Voucher. 2020 Vermont Tax Rate Schedules Example.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Monday February 8 2021 - 1200. Filing Status is Married Filing Jointly.

TaxTables-2020pdf 27684 KB File Format. Individuals Personal Income Tax. The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax.

Vermont Tax Brackets for Tax Year 2020. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. PA-1 Special Power of Attorney.

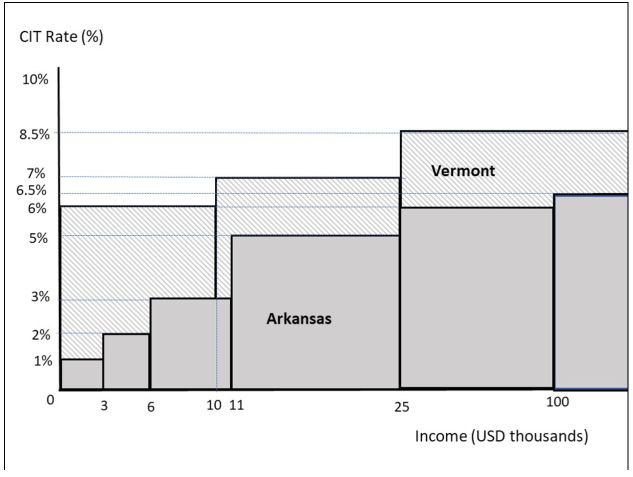

Pay Estimated Income Tax by Voucher. Pay Estimated Income Tax Online. Vermont also has a 600 percent to 85 percent corporate income tax rate.

2020 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Base Tax is of 3220. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017Vermonts tax brackets are indexed for inflation.

State By State Guide To Taxes On Middle Class Families Kiplinger

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Tax Complexity And Transfer Pricing Blueprints Guidelines And Manuals

Will Mississippi Join The No Income Tax Club

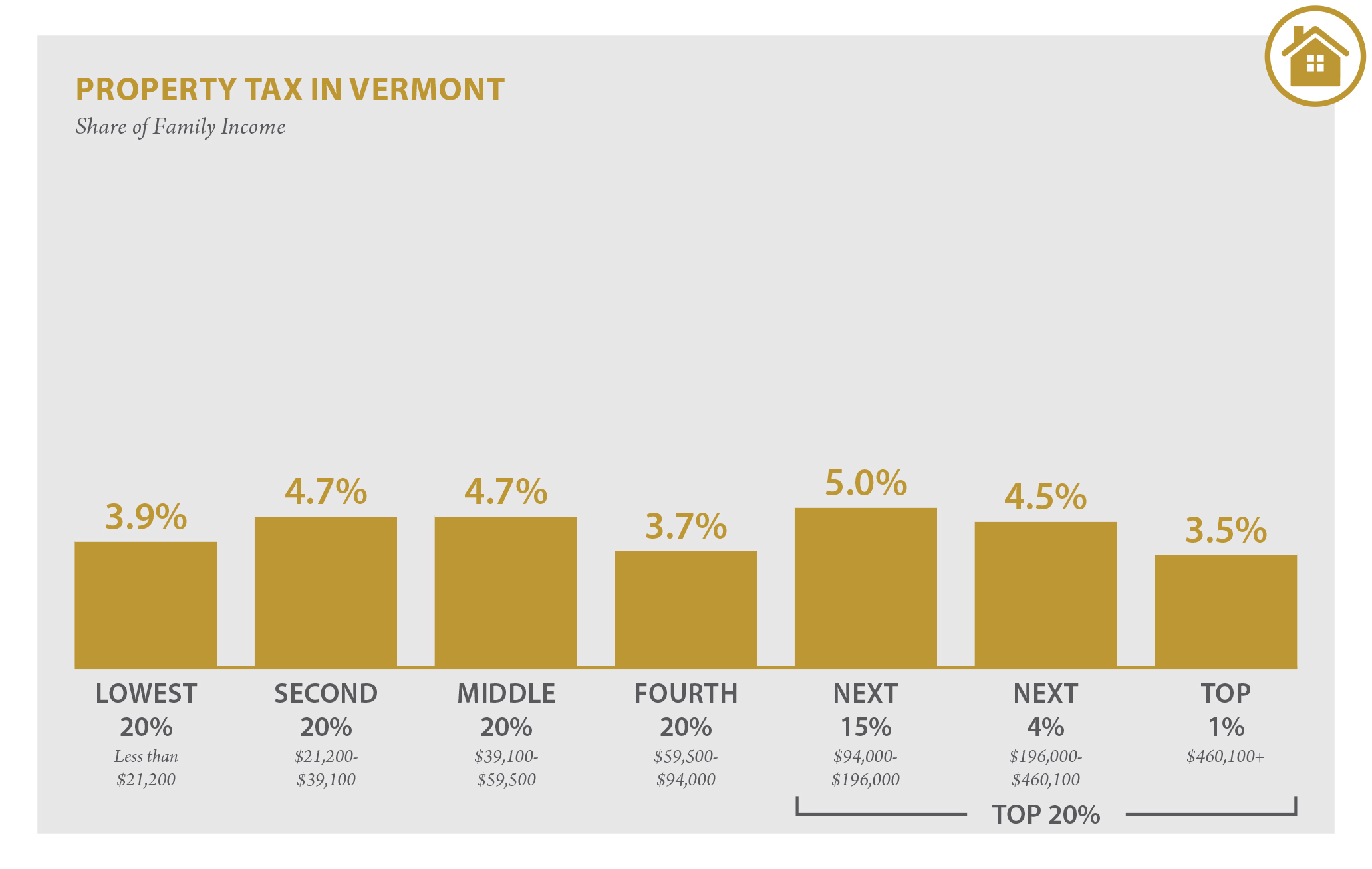

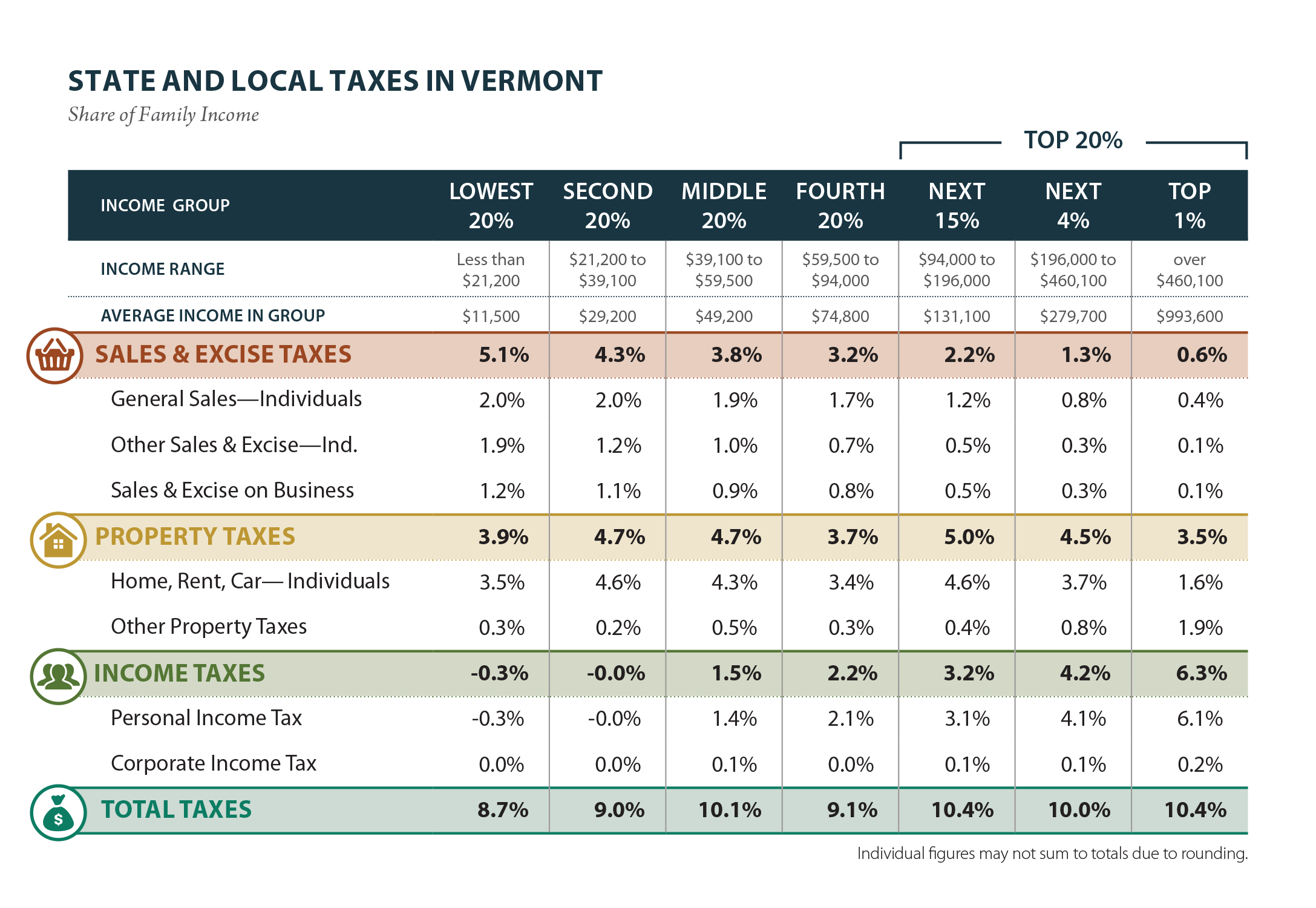

Vermont Who Pays 6th Edition Itep

Vermont Property Tax Rates Nancy Jenkins Real Estate

Vermont Tax Registration Fill Out And Sign Printable Pdf Template Signnow

Pandemic Profits Netflix Made Record Profits In 2020 Paid A Tax Rate Of Less Than 1 Percent Itep

Vermont Who Pays 6th Edition Itep

Illinois Sales Tax Rate Rates Calculator Avalara

Fy 2020 Tax Structure Explained Winners And Losers Vermont Business Magazine

Personal Income Tax Department Of Taxes

Metis Wealth Management And Planning Lower Your Taxes By Moving

Vermont Income Tax Calculator Smartasset

State Budgets Are So Flush Even Vermont California Progressives Are Cutting Taxes